51+ is there a penalty for paying off a mortgage early

A 5-year adjustable-rate mortgage 51 ARM can be paid off early. This also means that an early repayment charge will be much lower if youre closer to paying.

126 N Liberty St Webb City Mo 64870 Zillow

Ad Debt consolidation loans help borrowers combine high-interest debts into a single payment.

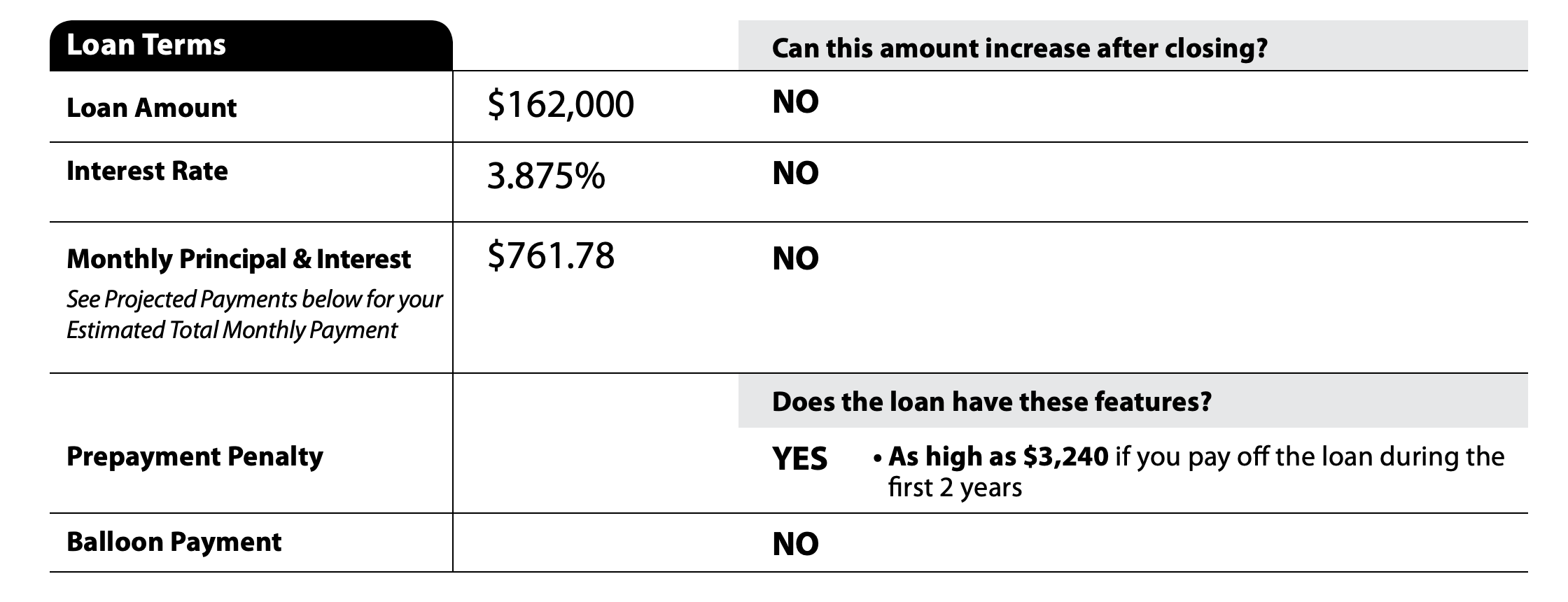

. Remaining mortgage debt 150000 25. Web Some loans have pre-payment penalties during the first years of the loan. Web Prepayment penalties are fees that some lenders may charge to borrowers who pay off part or all of their loan earlier than what is stated in the terms of the loan.

However there may be a prepayment penalty. Web If your mortgage is the exception to the rule a prepayment penalty can only be assessed in the first three years. Web You have to pay a prepayment penalty of 12000 which is the higher of the 2 amounts.

Web Below are some examples based on different overpayments that you might make towards repaying your mortgage early. These fees may impose substantial costs on homeowners with adjustable rate mortgage. Web A mortgage prepayment penalty is a fee that lenders may charge if you pay off some or all of your mortgage early.

For instance if your remaining balance is 250000 and you pay down your mortgage. Web A mortgage prepayment penalty is a fee you pay the lender if you sell refinance or pay off your mortgage within a certain amount of time of closing on your. Web A mortgage prepayment penalty is a fee you pay the lender if you sell refinance or pay off your mortgage within a certain amount of time of closing on your.

Web Make extra mortgage payments. How Much Interest Can You Save By Increasing Your Mortgage Payment. For the first two years after the loan is consummated the penalty cant be greater than 2 of the amount of the.

Its capped at 2 percent in years one and two and 1. Web If the mortgage is prepaid in the 2nd year the penalty becomes 1 percent of the balance. Web If you can afford to completely pay off a mortgage within the first year or two after borrowingor refinance at a much lower ratethen it may be beneficial to just pay.

Web The prepayment penalty for this mortgage depends on how far the borrower is into the loan. Web But if you switched in year five it would be less expensive at only 2000. The easiest way to pay off your mortgage early is by making extra payments ideally toward the principal loan amount.

Web Can you pay off a 51 arm early. Review your mortgage contract to find. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web Up to 25 cash back Amount Limitations for Prepayment Penalties. You may also have to pay an administration fee. Web A prepayment penalty is a fee that some lenders charge if you pay off all or part of your mortgage early.

This includes when you refinance your home as. If you have a prepayment penalty you would have agreed. Compare the best consolidation loans for fast funding bad credit low rates and more.

Say the borrower is 1 year into the loan and has an outstanding.

Should You Pay Off Your Mortgage Before Retirement There Are Pros And Cons

Are There Fees For Paying Off Mortgage Early Moneylion

What Is A Prepayment Penalty Hard Vs Soft And More

5 Mistakes To Avoid When Paying Off Your Mortgage Early Smartasset

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Why Paying Off The Mortgage Early May Be A Big Mistake

2045 S Maple St Carthage Mo 64836 Zillow

Homecare Estates

Business Pittbusiness Magazine 2009 By Kelly Sjol Issuu

What Is A Mortgage Prepayment Penalty The Motley Fool

5 Mortgage Mistakes I Made Paying Off My Mortgage Early March 2023

44 Conch Drive Executive Home The Boulevard Id 414464 Rhulens

Prepayment Penalty What It Is And How To Avoid It Credible

Prepayment Penalty What It Is And How To Avoid It Rocket Mortgage

How To Pay Off Mortgage Early Uk Youtube

2974 Se Camino Ave Stuart Fl 34997 Realtor Com

4676 Se Basswood Ter Stuart Fl 34997 Realtor Com